How does debt affect our lives?

There's a strong link between debt and poor mental health. People with debt are more likely to face common mental health issues, such as prolonged stress, depression, and anxiety. Debt can affect your physical well-being, too. This is especially true if the stigma of debt is keeping you from asking for help.

Debt affects your life financially, emotionally, mentally, and physically. It can cause anxiety, depression, and mental illness. It can cause a host of physical health problems. It can lead to debt denial.

A nation saddled with debt will have less to invest in its own future. Rising debt means fewer economic opportunities for Americans. Rising debt reduces business investment and slows economic growth.

The worries of debt and persistent creditor contact can also result in stress, which if left untreated, can cause further problems such as difficulty sleeping, extreme anxiety, muscle tension, chest pain and irritability.

Debt is an important, if not essential, tool in today's economy. Businesses take on debt in order to fund needed projects, while consumers may use it to buy a home or finance a college education.

Having too much debt can make it difficult to save and put additional strain on your budget. Consider the total costs before you borrow—and not just the monthly payment. It might sound strange, but not all debt is "bad." Certain types of debt can actually provide opportunities to improve your financial future.

- Loan repayment. One downside of debt financing is that a business is required to repay it. ...

- High rates. ...

- Restrictions. ...

- Collateral. ...

- Stringent requirements. ...

- Cash flow issues. ...

- Credit rating issues.

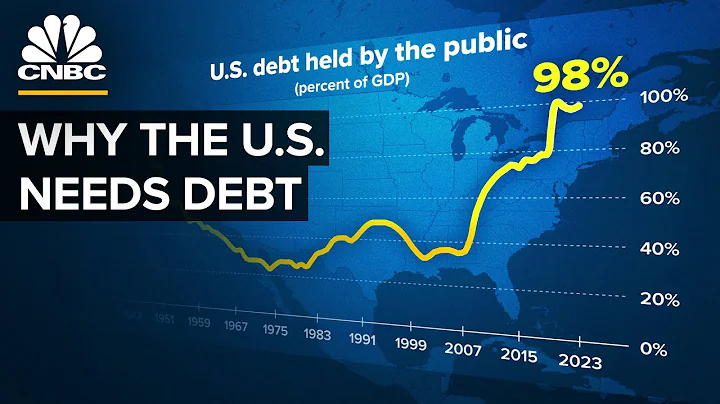

Nearly every year, the government spends more than it collects in taxes and other revenue, resulting in a deficit. (The debt ceiling, set by Congress, caps how much the U.S. can borrow to pay for its remaining bills.) The national debt, now at a historic high, is the buildup of its deficits over time.

Debt-to-income ratio is your monthly debt obligations compared to your gross monthly income (before taxes), expressed as a percentage. A good debt-to-income ratio is less than or equal to 36%. Any debt-to-income ratio above 43% is considered to be too much debt.

Tax cuts, stimulus programs, increased government spending, and decreased tax revenue caused by widespread unemployment account for sharp rises in the national debt.

How does debt impact Americans quality of life?

Similarly, reporting from consumer information site The Simple Dollar suggests that individuals who struggle to pay off their debts and loans “are more than twice as likely to experience a host of mental health problems, including depression and severe anxiety,” according to one prominent study, which also suggests ...

If a country's debt crisis is severe enough, it could result in a sharp economic slowdown at home that impedes economic growth elsewhere in the world. Rising costs of food and other goods and services due to inflation as a government prints money to support its expenditures.

Financial strain can make for a stressful home environment due to the pressure of a barrage of letters and phone calls, and even the threat of losing the roof over their head. Because of this, half of families claim that their intense situation has caused arguments within their family.

The national debt has increased every year over the past ten years. Interest expenses during this period have remained fairly stable due to low interest rates and investors' judgement that the U.S. Government has a very low risk of default.

Pros of debt financing include immediate access to capital, interest payments may be tax-deductible, no dilution of ownership. Cons of debt financing include the obligation to repay with interest, potential for financial strain, risk of default.

Many people believe that having no debt is ideal, but in many situations, debt can actually be considered good for your finances if it helps you build wealth. For example, if you cannot afford to buy a home with cash, you may go into debt with a mortgage.

Key Takeaways

If you cannot afford to pay your minimum debt payments, your debt amount is unreasonable. The 28/36 rule states that no more than 28% of a household's gross income should be spent on housing and no more than 36% on housing plus other debt.

Bad debt refers to loans or outstanding balances owed that are no longer deemed recoverable and must be written off.

The largest holder of U.S. debt is the U.S government. Which agencies own the most Treasury notes, bills, and bonds? Social Security, by a long shot. The U.S. Treasury publishes this information in its monthly Treasury statement.

In total, other territories hold about $7.4 trillion in U.S. debt. Japan owns the most at $1.1 trillion, followed by China, with $859 billion, and the United Kingdom at $668 billion.

Who owns U.S. debt?

In December 2021, debt held by the public was estimated at 96.19% of GDP, and approximately 33% of this public debt was owned by foreigners (government and private). The United States has the largest external debt in the world.

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals. Let's take a closer look at each category.

The average amount is almost $30K. Some have more, while others have less, but it's a sobering number. There are actions you can take if you're a Millennial and you're carrying this much debt.

$5,000 in credit card debt can be quite costly in the long run. That's especially the case if you only make minimum payments each month. However, you don't have to accept decades of credit card debt.

Eliminating the U.S. government's debt is a Herculean task that could take decades. In addition to obvious steps, such as hiking taxes and slashing spending, the government could take a number of other approaches, some of them unorthodox and even controversial.

References

- https://www.cbsnews.com/news/who-qualifies-for-credit-card-debt-forgiveness/

- https://www.investopedia.com/terms/b/baddebt.asp

- https://www.fool.com/the-ascent/credit-cards/over-25k-credit-card-debt-pay-off/

- https://upsolve.org/learn/debt-forgiveness-options-and-consequences/

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-relief-program-and-how-do-i-know-if-i-should-use-one-en-1457/

- https://www.moneymanagement.org/blog/understanding-the-statutes-of-limitations-on-debt

- https://www.cas.org.uk/news/we-need-take-shame-out-being-debt

- https://www.cbsnews.com/news/the-fastest-ways-to-pay-off-debt/

- https://www.gundersonfirm.com/debt-money-issues-impacting-quality-of-life/

- https://www.creditkarma.com/insights/i/average-debt-by-age

- https://www.schwabmoneywise.com/essentials/good-debt-vs-bad-debt

- https://www.creditninja.com/blog/can-you-have-a-700-credit-score-with-collections/

- https://www.bankrate.com/finance/credit-cards/states-with-most-credit-card-debt/

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://wallethub.com/answers/cc/how-long-to-pay-off-50000-credit-card-debt-1000423-2140858504/

- https://wallethub.com/answers/cc/what-percentage-of-america-is-debt-free-2140664784/

- https://www.forbes.com/advisor/banking/american-debt-and-the-mental-health-epidemic/

- https://worldpopulationreview.com/country-rankings/countries-by-national-debt

- https://www.launchfinance.com.au/golden-rules-of-finance/

- https://www.cnn.com/cnn-underscored/money/how-to-get-out-of-debt

- https://www.investopedia.com/ask/answers/12/reasonable-amount-of-debt.asp

- https://www.capitalone.com/learn-grow/money-management/good-debt-vs-bad-debt/

- https://www.washingtonpost.com/business/2023/07/14/poverty-global-economy-debt-un/

- https://www.lendingtree.com/auto/debt-to-income-ratio-for-car-loan/

- https://www.nasdaq.com/articles/4-borrowing-rules-rich-people-follow-but-others-often-dont

- https://www.principal.com/individuals/build-your-knowledge/3-ways-pay-your-debt

- https://www.marketplace.org/2023/05/26/who-does-the-u-s-owe-31-4-trillion/

- https://www.self.inc/info/debt-by-age-group-generation/

- https://www.investopedia.com/terms/d/debtor.asp

- https://www.citizensbank.com/learning/how-much-debt-is-too-much.aspx

- https://www.lightspeedhq.com/blog/advantages-of-debt-financing/

- https://www.investopedia.com/terms/f/five-c-credit.asp

- https://www.wellsfargo.com/goals-credit/smarter-credit/manage-your-debt/pay-off-debt-faster/

- https://en.wikipedia.org/wiki/Financial_position_of_the_United_States

- https://www.incharge.org/debt-relief/how-much-debt-is-too-much/

- https://www.cbsnews.com/news/great-ways-to-pay-off-20000-in-credit-card-debt/

- https://www.oxfordlearnersdictionaries.com/definition/english/national-debt

- https://www.beckersasc.com/asc-news/the-14-medical-careers-with-the-highest-student-loan-debt.html

- https://www.experian.com/blogs/ask-experian/how-to-pay-off-20000-in-credit-card-debt/

- https://www.pgpf.org/top-10-reasons-why-the-national-debt-matters

- https://www.marketwatch.com/picks/i-have-20k-in-credit-card-debt-and-pay-400-a-month-just-in-interest-im-worried-about-this-large-sum-of-interest-im-paying-what-should-i-do-01675358619

- https://wallethub.com/answers/cs/how-to-remove-collections-from-credit-report-without-paying-2140646704/

- https://financebuzz.com/government-debt-relief-programs

- https://hk.indeed.com/career-advice/career-development/advantages-and-disadvantages-of-debt-finance

- https://www.tcdebtsolutions.com/articles/posts/2019/july/the-effects-of-debt-on-family-life/

- https://www.ed.gov/news/press-releases/biden-harris-administration-approves-12-billion-loan-forgiveness-over-150000-save-plan-borrowers

- https://www.nerdwallet.com/article/credit-cards/15000-credit-card-debt

- https://www.businessinsider.com/personal-finance/average-american-debt

- https://www.cnbc.com/select/debt-free-by-age-45/

- https://www.treasurydirect.gov/kids/history/history.htm

- https://www.experian.com/blogs/ask-experian/actions-that-can-lower-your-credit-score/

- https://www.equifax.com/personal/education/credit/score/articles/-/learn/what-is-a-good-credit-score/

- https://www.moneyandmentalhealth.org/money-and-mental-health-facts/

- https://www.stepchange.org/debt-info/debt-collection/can-debts-be-sold-on.aspx

- https://www.incharge.org/debt-relief/credit-counseling/success-stories/how-i-paid-off-30000-in-credit-card-debt/

- https://debtmovement.co.uk/debt-help/health-and-wellbeing/effects-of-debt

- https://www.cbsnews.com/news/ways-to-pay-off-10000-in-credit-card-debt/

- https://abcnews.go.com/Politics/us-national-debt-grew-314-trillion-high/story?id=99429867

- https://www.farmermorris.com/faqs/11-word-phrase-to-stop-debt-collectors/

- https://www.investopedia.com/terms/c/chargeoff.asp

- https://www.moneyfit.org/what-age-to-be-debt-free/

- https://cozinhacabral.com/20-10-rule-to-calculate-debt-limits/

- https://www.cbsnews.com/news/how-long-will-it-take-to-pay-off-5000-in-credit-card-debt/

- https://www.merriam-webster.com/thesaurus/debts

- https://www.nolo.com/legal-encyclopedia/options-you-cant-pay-your-debts.html

- https://www.bostonherald.com/2023/03/14/the-average-millennial-has-nearly-30k-in-debt-here-is-what-they-should-do/

- https://www.thesaurus.com/browse/in-debt

- https://www.forbes.com/advisor/debt-relief/freedom-debt-relief-review/

- https://www.investopedia.com/terms/d/debt.asp

- https://www.gymglish.com/en/gymglish/english-translation/to-be-in-somebodys-debt

- https://www.clearoneadvantage.com/blog/5-ways-debt-affects-your-life

- https://www.cbsnews.com/minnesota/news/good-question-how-did-the-u-s-debt-get-so-high/

- https://wallethub.com/answers/cc/how-long-to-pay-off-20000-credit-card-debt-1000423-2140858500/

- https://www.huffpost.com/entry/jerome-kerviel-most-debt-in-the-world_n_2077219

- https://en.wikipedia.org/wiki/National_debt_of_the_United_States

- https://www.linkedin.com/pulse/how-rich-use-debt-avoid-taxes-get-richer-jake-hoffberg

- https://www.investopedia.com/articles/economics/11/successful-ways-government-reduces-debt.asp

- https://www.forbes.com/advisor/debt-relief/national-debt-relief-review/

- https://finance.yahoo.com/personal-finance/do-i-qualify-for-student-loan-forgiveness-194501496.html

- https://fiscaldata.treasury.gov/americas-finance-guide/national-debt/

- https://www.cnbc.com/select/average-american-debt-by-age/

- https://www.cbsnews.com/news/how-to-pay-off-15000-in-credit-card-debt/

- https://moneymentors.ca/money-tips/how-to-live-a-debt-free-life/

- https://www.bankrate.com/personal-finance/debt/men-women-and-debt-does-gender-matter/

- https://www.investopedia.com/ask/answers/051215/how-can-countrys-debt-crisis-affect-economies-around-world.asp

- https://usafacts.org/articles/which-countries-own-the-most-us-debt/

- https://www.law.cornell.edu/wex/debt

- https://money.com/average-american-personal-debt-amount/

- https://www.investopedia.com/financial-edge/0611/june-20-5-ways-the-u.s.-can-get-out-of-debt.aspx

- https://www.cbsnews.com/news/student-loan-forgiveness-eligibility-guidance-update/

- https://www.investopedia.com/terms/f/ficoscore.asp

- https://www.quora.com/If-China-sells-all-US-treasury-bonds-what-will-happen-to-the-US-economy

- https://www.quora.com/Is-it-better-to-be-poor-or-in-debt-with-a-lot-of-money

- https://www.thebalancemoney.com/who-owns-the-u-s-national-debt-3306124

- https://www.guardiandebtrelief.com/bad-debt-ruins-life-debt-help/

- https://www.cnbc.com/select/debt-and-mental-health/

- https://www.texasattorneygeneral.gov/consumer-protection/financial-and-insurance-scams/debt-collection-and-relief/your-debt-collection-rights

- https://www.marketplace.org/2024/01/30/us-national-debt-34-trillion/

- https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp

- https://quizlet.com/94881172/debt-vocabulary-flash-cards/

- https://www.superfastcpa.com/what-is-the-difference-between-a-liability-and-a-debt/

- https://moneyguy.com/episode/how-many-americans-dont-have-1000-shocking-stat/

- https://finance.yahoo.com/news/top-20-countries-owe-us-175515001.html

- https://files.consumerfinance.gov/f/documents/cfpb_building_block_activities_what-is-debt_handout.pdf

- https://www.moneylion.com/learn/debt-after-7-years/

- https://www.investopedia.com/articles/markets-economy/090616/5-countries-own-most-us-debt.asp

- https://www.consolidatedcredit.org/how-to-get-out-of-debt-if-youre-living-paycheck-to-paycheck/

- https://www.investopedia.com/articles/pf/12/good-debt-bad-debt.asp

- https://www.northcountrysavings.bank/blog-article/oprahs-debt-diet-what-it-how-you-can-benefit

- https://www.cnbc.com/select/how-to-pay-off-credit-card-debt-in-one-year/

- https://www.fcwlegal.com/bankruptcy/what-can-and-cannot-be-discharged-in-bankruptcy/

- https://upsolve.org/learn/happens-dont-pay-collection-agency/

- https://www.investopedia.com/ask/answers/110614/what-are-main-categories-debt.asp

- https://www.nerdwallet.com/article/loans/student-loans/if-scotus-blocks-student-debt-relief-1965-law-could-be-plan-b

- https://www.equifax.com/personal/education/credit/report/articles/-/learn/how-long-does-information-stay-on-credit-report/

- https://www.businessinsider.com/personal-finance/average-credit-score

- https://www.investopedia.com/updates/usa-national-debt/

- https://www.cnbc.com/select/average-debt-for-20-year-olds/

- https://www.cbsnews.com/news/can-i-get-my-credit-card-debt-written-off/